Dental insurance in UK 2023: The National Health Service (NHS), the public health system of the United Kingdom, provides citizens and residents with access to affordable and sometimes even free dental care. However, coverage is frequently limited to “clinically necessary” treatments and services for maintaining dental and oral health. If your teeth require more extensive procedures, you may benefit more from purchasing private dental insurance.

This article from Insurance Business explains how this type of coverage works. This comprehensive guide can help you decide whether to purchase a separate dental insurance plan if you’re still on the fence. This is an excellent article for the insurance professionals who make up the majority of our audience to share with clients who have questions about dental insurance in the United Kingdom.

How does dental insurance work in the UK?

As the name suggests, dental insurance policies pay for the cost of dental care. Brits can access cover in two ways:

1. As an add-on to your health insurance plan

If you already have health insurance, you can purchase a dental add-on to gain access to a comprehensive range of dental treatments and services. Your premiums will likely be higher than if you purchased dental insurance separately, but coverage will not be restricted to standard procedures.

Our global health insurance guide explains how private health insurance works in Australia, North America, and the United Kingdom.

2. As a standalone cover

A separate private dental insurance policy does not provide the same level of coverage as a health insurance add-on; rather, it pays a maximum amount for standard procedures. Some policies provide coverage for emergency care even if you’re traveling abroad.

A few insurers provide immediate coverage for certain treatments, whereas the majority of dental insurance policies require a one- to three-month waiting period before you can begin to file claims. However, if you haven’t been to the dentist within the past 12 to 24 months, some policies will not cover procedures or identified treatments at your first checkup.

In the United Kingdom, dental insurance follows a reimbursement model, which necessitates out-of-pocket payment prior to reimbursement. Both the National Health Service (NHS) and private clinics offer dental procedures and services. If you select an NHS dentist, you are more likely to cover the entire cost of your care. Otherwise, only a portion of the costs can be recovered.

What does dental insurance in the UK cover?

The following procedures are typically covered by dental insurance, regardless of whether they are performed in NHS or private clinics:

- Routine practices: simple extractions, fillings, crowns, dentures, and root canals are common dental procedures.

- Exams, basic care, and X-rays comprise routine care.

- First-aid services: acute and unforeseen conditions requiring prompt treatment

- Impact injuries: Treatment for injuries caused by an external force, such as automobile accidents, typically excludes sports injuries.

- Oral cavity cancer treatment includes surgery, radiation therapy, and chemotherapy.

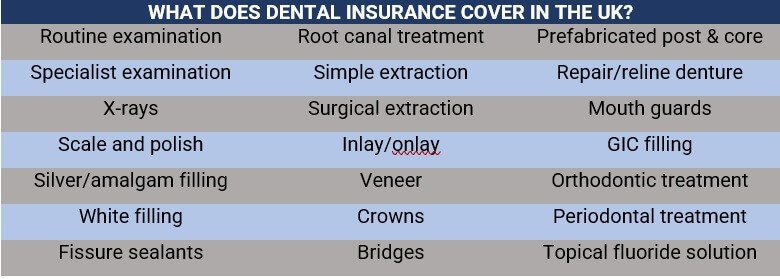

- The following table details the common procedures and treatments covered by private dental insurance policies in the United Kingdom.

What isn’t covered by dental insurance in the UK?

There are exceptions to private dental insurance’s broad coverage of treatments and procedures. Included among these are:

- Cosmetic dental treatments: tooth contouring, dental bonding, and teeth whitening

- Previous medical conditions: existing dental problems at the time the policy was adopted

- Surgical implants: Any procedure involving surgical implants or related to them

- Procedures performed during the interval: Most policies impose a one- to three-month waiting period before a claim can be filed.

How much does dental insurance cost in the UK?

According to the calculations of multiple insurers and price comparison websites consulted by Insurance Business, the annual cost of dental insurance in the United Kingdom can range from £65 to over £300. Dental insurance premiums can vary significantly based on a variety of factors, such as:

- Dental history of a patient

- Age under address

- Coverage degree

Whether care will be administered in an NHS practice or a private clinic

When choosing a policy, it is important to keep in mind that cheaper does not always imply better. Choosing a less expensive plan with limited coverage may cost you more in the long run, particularly if you need extensive dental treatments and procedures. When choosing a policy, it is best to consider your circumstances carefully to ensure that the protection you are receiving meets your needs and is within your budget.

What is the difference between dental insurance and dental payment plans?

Both dental insurance and dental payment plans provide you with access to a broader range of coverage than the NHS. However, payment for dental treatments and services is the key distinction.

Check Also: Top Life Insurance Companies in USA 2023

As previously mentioned, dental insurance follows a reimbursement system that requires you to pay for the services upfront before submitting a claim. In a dental health plan, also known as a capitation plan, you can make monthly payments to cover the cost of treatment over the course of a year. This is advantageous for patients who cannot afford to pay the total bill immediately following a procedure. The monthly average costs, however, are comparable to those of more expensive dental insurance policies.

Under a dental payment plan, there are two coverage levels available for enrollment. These include:

- This level of coverage includes check-ups, polishing, X-rays, and fillings.

- In addition to level one inclusions, level two coverage includes restorative procedures such as crowns and root canal fillings.

- You can also use plans designed for children, as well as those that cover dental injuries and emergency care, even when traveling abroad.

In addition, dental payment plans tie you to a particular dentist. This implies that if you were referred to a specialist, such as an orthodontist, for treatment, it would not be covered. If you move to a new area and switch dentists, you may have to restart the entire process, which can increase your monthly payments.

Can you access dental care through the NHS?

Obviously, the NHS provides access to dental care as well. However, coverage is restricted to treatments and services deemed clinically necessary. These consist of:

- Check-ups

- Unplanned appointments

- X-rays \sExtractions

- Crowns dentures shillings

In exceptional cases, dental implant procedures may be covered if they are medically necessary. Orthodontic treatments such as braces are also covered, but only for children under 18 years old. Nonetheless, children must meet the eligibility requirements established by the Index of Orthodontic Treatment (IOTN), which grades patients based on dental issues and the necessity of treatment for health and/or aesthetic reasons. After qualifying, they will be placed on a waiting list.

And similar to the majority of stand-alone dental insurance plans, cosmetic procedures such as composite bonding and teeth whitening are not covered.

Depending on your situation, you may have access to free NHS dental treatments and services. If you do not qualify for free dental care, the government will subsidize the cost of your treatment.

England and Wales implement a three-tier pricing structure, whereas residents in Scotland are required to pay 80% of the treatment cost. You can obtain complete information about NHS dental costs in your region by visiting the following government websites:

- National Health Service (England)

- National Health Service 111 Wales

- Scottish Government

- Business Services Organisation (Northern Ireland)

Is taking out dental insurance worth it?

Private dental insurance is not for all individuals. If you fall into one of the following categories, you probably do not need private dental insurance:

- Earner with a low income

- Under 19 years of age

- Eligible for free NHS dentistry

If your teeth are healthy and you only need to see your dentist once a year, dental insurance may be a waste of money. However, it is also understandable if you wish to acquire coverage so you can access a wider variety of treatment options in the event of an unforeseen circumstance.

If your teeth are not in good condition and require regular treatment, dental insurance may be a worthwhile investment. If you do not have access to a dentist on the National Health Service or if you prefer to use the services of a private clinic, you may benefit from private coverage.

Consider also the following advantages of private dental insurance that the NHS cannot offer:

- Extends coverage beyond “clinically necessary” procedures, sometimes to the point of including cosmetic treatments.

- Shorter wait times allow for quicker access to treatments and services, as well as the use of better facilities.

- Unlike NHS appointments, which last an average of 10 to 15 minutes, private appointments provide ample time for you and your dentist to discuss long- and short-term issues that may be affecting your dental health.

- Access to specialists: This provides access to a greater number of dentists who can meet your specific needs.

- The majority of private dentists offer more flexible hours, allowing you to visit them at a time that is more convenient for you.

- These benefits come with a corresponding price tag. The cost of coverage is the most significant drawback of private dental insurance. After purchasing a policy, you will be required to pay monthly premiums that you may never use. You must decide if this disadvantage outweighs the peace of mind you will gain by purchasing insurance.

The operation of dental insurance varies depending on one’s location. If you’re interested in how this type of coverage operates in the United States, you can consult our comprehensive guide to American dental insurance.

What do you believe are the advantages and disadvantages of dental insurance in the United Kingdom? Please feel free to share your opinions in the section below.

People Also Ask

-

How much is dental insurance in the United Kingdom?

Costs for dental insurance can range between £70 and £300 per year, depending on the insurer and policy. Many offer a range of coverage levels, from basic routine care to comprehensive treatment plans. So you can decide how much you wish to spend and how much coverage you desire.

-

Is dental insurance free in the United Kingdom?

You are eligible for free NHS dental care if you or your spouse (including a civil partner) receive any of the following: Income Support. Allowance for employment and support based on income. Income-based unemployment benefit.